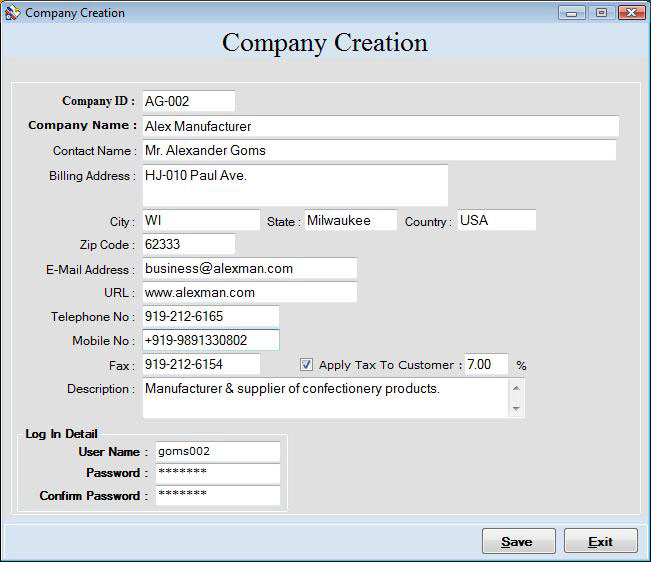

The small business accounting package free download - Small Business Accounting PRO, Accounting -- small business, QuickBooks Accounting for Small Business.

With a million and one things to do each day, accounting doesn’t always take priority on small business owners to do lists. Taking advantage of accounting software can help small businesses manage invoices and payrolls with greater ease and efficiency. And without any costs to fork out, accounting software is even better when it’s free!

Free Accounting Software for Small Business

Take a look at the following ten best free accounting software options for small businesses.

ZipBooks

ZipBooks provides powerful and simple-to-use accounting software designed to help small businesses move to the next level. ZipBooks’ free starter option includes unlimited invoicing, unlimited vendors and customers, unlimited bookkeeping, the ability to connect and manage one bank account, and a business health and invoice quality score.

xTuple PostBoks

xTuple PostBooks is enterprise resource planning (ERP) software, which means that in addition to accounting, small businesses can track sales, integrate inventory and take advantage of a customer management system. The free license program does not provide any specialized support.

SlickPie

SlickPie provide basic expense management for start-ups and small businesses. This easy-to-use expense management software provides everything a small business will need for slick and timely accounting, including straightforward invoicing and detailed reports to help keep their business finances healthy.

Wave

Wave provides completely free accounting that allows small businesses to track expenses, send invoices, get paid and balance their books. Businesses can send professional invoices and track the status of invoices and payments, so they know when to expect money in their bank account. Businesses can also accept credit cards and get paid faster with Wave.

Inv24

Inv24 is a free inventory management and invoicing software, which enables small businesses to automatically organize and invoice their customers. With Inv24, business owners can download PDF versions of invoices or send them by email.

Brightbook

Brightbook is a free online accounting system, designed to help time-strapped and cash-strapped small businesses with no accounting experience run their business easier. Businesses can send professional-looking invoices in any currency, track bills and find out who owes them money in an instant with the easy-to-use Brightbook system.

TurboCash

Microsoft Small Business Accounting

TurboCash 4 provides free accounting software that is recommended for people earning less than $10 an hour. TurboCash 5 is recommended for small businesses, with cash book, general ledger, stock, debtors, creditors and invoicing features. TurboCash 5 is now available as a Cloud Service. Unlike TurboCash which is free, TurboCash 5 costs $60 a year.

Inveezy

Inveezy is a free invoicing tool for small businesses. Users can customize their invoices with their own logos and use the service to send repeated invoices. Businesses can get paid with PayPal or credit cards with the Inveezy system. Businesses also have the option to send an invoice as a quote as opposed to an actual bill.

GnuCash

Quickbooks

GnuCash provides a simple approach to bookkeeping and accounting for small businesses. This free accounting software is available for Android, Linux, Windows, OS X, FreeBSDm GNU and OpenBSD. The software manages invoices, accounts payable and receivable, as well as employee expenses and some payroll features.

CloudBooks

CloudBooks provides businesses with an effective invoicing tool designed to create efficient and timely billing. The CloudBooks’ Free Forever is a free tool for a single client. Businesses can take advantage of CloudBooks’ dedicated team, which can provide an integrated assistance and priority support to meet the needs of their business.

Photo via Shutterstock

Editor's note: QuickBooks' Essentials plan is now $40 per month (or $20 for the first three months with the 50% discount), and its Plus plan is now $70 per month (or $35 for the first three months with the 50% discount). We will consider this information as part of our full evaluation when we next update the accounting software reviews.

To find the best small business accounting software overall, we evaluated dozens of accounting programs. It was imperative that the application be well suited for a range of business types and sizes, scalable so it can grow with your business and that it offer a healthy selection of integrations available so it can share data with the other business systems you use. We also wanted it to be easy to use and have timesaving features that reduce manual data entry and automate some of the most tedious accounting tasks, such as bank reconciliation. Finally, we wanted it to have a robust mobile app that gives you the data you need to monitor your business and accomplish basic accounting tasks remotely.

After much research and analysis of accounting software, we recommend Intuit's QuickBooks Online as the best accounting software for small businesses in 2019.

Why QuickBooks Online?

Competitively Priced

QuickBooks Online is competitively priced, with five service tiers designed to accommodate the needs of different business types. The company gives you the choice of either a 30-day free trial or a 50 percent discount on your subscription for three months. If you want to try out the software without forfeiting the discount, you can test-drive the demo account on the company's website.

- The Self-Employed plan is the most basic and costs $10 per month. Designed for independent contractors and freelancers, it allows you to track mileage, income and expenses, create invoices, accept payments, and run basic reports. This is the only plan that can't be upgraded to a higher tier, requiring you instead to set up a new account.

- The Simple Start plan supports a single user and costs $20 per month. Like the Self-Employed plan, it allows you to track income and expenses, create invoices, accept payments and run basic reports. However, you can also send estimates, and it tracks sales and sales tax, but it doesn't track mileage.

- The Essentials plan supports up to three users and costs $35 per month. It includes the features of the previous plan, along with bill management and time tracking.

- The Plus plan supports five or more users and costs $60 per month. In addition to the features of the previous plans, you can track inventory and projects, run advanced reports and manage independent contractors that use the 1099 form.

- The Advanced plan supports 10 or more users (up to 25 users) and costs $150 per month. Unlike the other plans, there isn't a free trial option with this plan. In addition to the features included in the Plus plan, you receive Smart Reporting powered by Fathom, five online QuickBooks classes to train your team and premium customer support. You're also assigned a dedicated customer success manager.

You can add payroll features to the top four tiers for an additional monthly fee, and these tiers are also suitable for nonprofits that need accounting software.

Ease of Use

To find out exactly how easy it is to use QuickBooks Online, we tried the accounting software ourselves. It was simple to get started with the software and add information to the system. The dashboard interface feels intuitive; the side menu makes it easy to find the features you're looking for, and you can access account settings from the gear icon in the upper right corner of the screen.

On the dashboard, you can see a snapshot of your financial status, with information such as overdue and paid invoices, sales, expenses, profits and losses, and the balances of the bank and credit card accounts you've connected to the system. This gives you a quick overview of the health of your business as soon as you log into the system, and you can click on each graph to go to its action menu or report.

Time-saving Features

When we asked small business owners what the 'perfect' accounting software should do, there was one resounding requirement across the board: save time. QuickBooks Online easily lives up to this expectation with the following features.

Automations. QuickBooks Online automates tasks, making accounting less time-consuming and less stressful for small business owners. The software can automate recurring invoices, bill payments, and payment reminders; sync data from bank and credit card transactions; and reconcile and categorize expenses – all of which eliminate the tedious, time-consuming task of manually doing so for every single transaction.

Built-in reports. QuickBooks spares you the task of creating financial reports from scratch, thanks to the software's built-in reports, which include the trial balance, general ledger and 1099 transaction detail reports that you'll need come tax time. You can mark the reports you use most as favorites so you can quickly find them at the top of the reports page. You can also set up the software to automatically run and email reports to you, and you can schedule them for a specific time of day and frequently, such as daily, weekly, monthly or quarterly.

Automatic backups. QuickBooks automatically backs up your data so you never worry about whether your books are safe and up-to-date.

Electronic invoicing. Another time-saving feature that QuickBooks offers is electronic invoicing, which helps you get paid more quickly. You can email invoices to customers through the system, track them, and accept online payments and electronic signatures.

- Invoice emails are optimized for mobile devices so customers that open them using their phones can view them with ease.

- If you use Gmail, QuickBooks Online has an app that allows you to create and send invoices directly from your Gmail account. The invoices are then saved both in Gmail and the accounting software.

- The project tracking feature that comes with the Plus plan has progress invoicing that allows you to bill customers in increments as you complete certain stages of the job or reach project milestones. The software automatically calculates how much you've billed for the project against the overall estimate.

Integrations. QuickBooks Online integrates with hundreds of third-party applications, such as those designed for email marketing, e-commerce, customer relationship management (CRM), payment processing, time tracking, payroll services and more. This can save you time by connecting the software to the business programs you already use, allowing you to automatically import, export and sync data in real time among the different services.

Mobile apps. This saves you time by allowing you to do your accounting and view your business's finances on the go. Both iOS and Android apps for phone and tablet are available and included with your QuickBooks Online account. Here's what they can do:

- Create, customize, send and track invoices

- Take photos of receipts and attach them to expenses

- Reconcile transactions

- View customer information, add new customers, and message customers directly from the app

- View dashboard data, such as your account balance, profit and loss report, and open current and past due invoices

- Accept payments on the go and online (after activating QuickBooks Payments)

Customer Service

QuickBooks Online provides several support channels to its customers. It offers both phone and chat support, which you can access directly throughout the company's website. Or, if you prefer to troubleshoot problems yourself, the support page has a searchable knowledgebase plus a collection of articles, guides and videos. The QuickBooks Self-Employed app has a new chatbot feature called QB Assistant that can answer a variety of questions about your account and connect you to live support.

The company also offers a blog, a user community and training classes that you can attend in person or online. If you want in-person assistance, QuickBooks gives you access to local certified QuickBooks ProAdvisors who can give you one-on-one help on using the software and advising your business.

When we contacted the company as a small business owner looking for new accounting software, the QuickBooks rep quickly transferred us to a sales rep, who was pleasant and helpful. He asked about our business and recommended a software plan based on our specific needs. He answered our questions promptly and provided a link to help us compare plans when we requested it.

Other Benefits

One of the biggest benefits of using QuickBooks Online is that it's 'accountant approved.' Not only does it have all the features accountants deem as must-haves for small businesses, it eliminates the learning curve since most accountants already use QuickBooks so you won't have to teach them how to use the software.

If you use an outside accountant, you can avoid compatibility issues since the software allows you to give him or her access to the system. Whether your accountants are helping you take better control of your finances or assisting only with tax prep, using accounting software that they're are already familiar with makes the process easier for everyone involved.

Small Business Accounting Software

Limitations

QuickBooks Online is an impressive accounting system that's easy to use and includes all of the features most small businesses need to efficiently accomplish their accounting tasks. However, there are some points to consider before you choose your software.

Free Small Business Accounting

- If you download the 30-day free trial, you forfeit the three-month, 50 percent discount. You can get a feel for the program, try out many its features and still qualify for the discount by using the free demo on the company's website.

- The self-employed plan isn't upgradeable to the small business plans, so if your business is growing or if you have (or plan to hire) employees, you may want to start with one of the small business plans instead.

- The plans limit the number of users who can access the system. Your accountant now counts toward your user number, so you'll want to take that into consideration as you choose a plan.

- Although the self-employed plan includes mileage tracking, the small business plans don't. If this is a feature you need now for your employees, you'll have to add an integration, find a workaround, or consider a different accounting application.

What Is Small Business Accounting

Ready to choose your accounting software? Here's a breakdown of our complete coverage: